All The New Stuff!

Disposable Vape – 3 Great Tips to Maximize Your First-Time Experience

First time with a Disposable Vape?If you switch from smoking to vaping, what is your first impression of the first puff? Does it taste too [...]

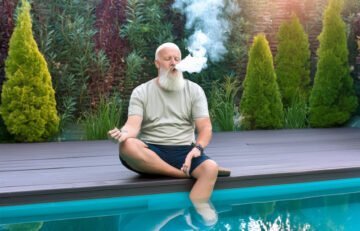

Can Smoking Weed in 2024 Make You Kinder? Examining the Empathy Link by a Baby Boomer Pothead

Don't you just love how cannabis chills people out and makes 'em all smiley and giggly? I mean, I've seen it with my own eyes [...]

Are Delta 8 Gummies Safe? Your Ultimate D8 Guide

In recent years, the cannabis market has seen an unprecedented explosion of new products and cannabinoids, each offering unique effects and benefits. Among these, delta [...]

Top-Selling 5% JUUL Pods at KingVapes Canada

The vaping landscape in Canada has been flourishing with innovation and consumer preferences shaping a diverse market. Amidst this vibrant scene, Kingvapes stands out as [...]

Unpacking the Controversy Surrounding Psilocybin and Magic Mushrooms in 2024

People often approach me at various social events after reading my articles on Psilocybin and magic mushrooms. (I'm fairly well-known in my community, much to [...]

Drop Your Disposable Vape in Water? 3 Tips to Fix It

I recently re-watched Superman III and was struck by how easily the supercomputer was disabled by a simple can of acid. It got me thinking [...]

Cannabis

All Things CBD

Kratom

Delta THC Reviews and Resources

Vape Gear Reviews Through the Years - 2011 - 2024

Spinfuel, since 2011, is widely recognized as one of the largest and most successful online magazines in the realm of CBD, Cannabis, Delta-THC, and vaping e-liquids with vape devices. This recognition is not without merit, as Spinfuel has carved out a unique space in the digital landscape, distinguishing itself through a commitment to providing the best and most accurate information to its readers. The reasons for its success as an online destination are multifaceted.

Spinfuel, since 2011, is widely recognized as one of the largest and most successful online magazines in the realm of CBD, Cannabis, Delta-THC, and vaping e-liquids with vape devices. This recognition is not without merit, as Spinfuel has carved out a unique space in the digital landscape, distinguishing itself through a commitment to providing the best and most accurate information to its readers. The reasons for its success as an online destination are multifaceted.

The Spinfuel Audience

Firstly, Spinfuel caters to a specific yet growing audience interested in CBD, Cannabis, Delta-THC, and of course, all types of vaping products. This niche focus allows them to provide specialized content that is highly relevant to their audience. In an online world where general information is abundant, Spinfuel’s targeted approach ensures that readers receive information that is not only relevant but also deeply insightful about the specific subjects they care about.

Secondly, the magazine’s commitment to truth and accuracy plays a significant role in its success. In an industry often clouded by misinformation and ambiguous regulations, Spinfuel stands out by offering reliable, thoroughly researched information. This dedication to truth is particularly crucial given the health implications and legal nuances associated with CBD, cannabis, and vaping products. Readers trust Spinfuel as a source that not only educates them but also prioritizes their safety and well-being.

Spinfuel Stays Current

Finally, Spinfuel understands the importance of staying current in a rapidly changing industry. The magazine continuously updates its content to reflect the latest scientific findings, product innovations, and legislative changes. This commitment to staying up-to-date ensures that readers always have access to the most current information, making Spinfuel an indispensable resource for anyone interested in Disposable Vapes, CBD, Cannabis, Delta-THC, Kratom, and even Magic Mushrooms.

In conclusion, Spinfuel’s success as the go-to online destination for information is a result of its specialized focus, commitment to truth, quality content, and up-to-date information. These elements combined create a trusted and comprehensive resource for readers navigating these complex and evolving industries. 2011-2023+